Facts About Bankrupt Melbourne Uncovered

Table of Contents7 Easy Facts About Personal Insolvency DescribedThe 25-Second Trick For Personal InsolvencyOur Personal Insolvency DiariesThe Best Strategy To Use For Bankrupt Melbourne3 Easy Facts About Bankruptcy Advice Melbourne ExplainedGetting The Bankruptcy Victoria To WorkWhat Does Bankruptcy Melbourne Do?

It can indirectly have a favorable influence on your credit history rating."Debt combination, A debt loan consolidation loan is an individual lending that you use to pay off various other financial debt, usually from credit score cards. Financial obligation combination finances normally have low set rate of interest and also terms lasting between one and 7 years.

Personal Insolvency Things To Know Before You Buy

Debt consolidation finances may cause your credit rating to dip at first because of the tough credit history inquiry that will certainly be needed to get the loan. Over time this approach to addressing financial debt may likewise improve your rating if you consistently make on-time repayments on the loan. Your settlement background is one of the most considerable consider your credit rating, making up 35 percent of the overall rating.

Nonetheless, there are choices to make your repayments much more manageable. Customers with government student fundings can choose to pursue deferment or forbearance for as much as three years overall. Relying on the sort of student loans you have and also the kind of alleviation you select, passion might still build up throughout this time.

Our Bankruptcy Statements

30, 2021, all government possessed student loans are automatically under forbearance with no passion amassing. Neither deferment or forbearance will certainly affect your credit history, but both will be kept in mind on your credit score record. Another choice for federal customers is to switch over to an income-driven settlement strategy with a finance forgiveness option.

The bright side with this approach is that there is no debt check called for to launch an income-driven payment plan as well as it will certainly not influence your credit report - Bankruptcy Advice Melbourne. If you have exclusive trainee finances, you may still be eligible for deferment or forbearance alternatives. This depends on the loan provider; if you're facing economic hardship, call your lending institution and inquire about your choices.

The 3-Minute Rule for Bankruptcy Advice Melbourne

Following actions, If you have not failed on your finances yet, you still have time to take into consideration various other choices. Your initial step must be to speak to every one of your lending institutions and also expense carriers as well as describe that you're dealing with the regular monthly settlements. Looking for a lower price, a deferment or a special repayment plan might save you from default or personal bankruptcy in the future.

It is advised that you get lawful recommendations about your scenario. After twelve months of looking for work he began to shed all hope. His lenders had actually additionally lost patience.

The Of Personal Insolvency

Repayments obtained before the review date of the insolvency are not safeguarded; Compensation got directly by you for injury (or residential property purchased virtually completely with payment money). Several of the major downsides of bankruptcy are: Most of your possessions (residential property you own) might be sold to pay your financial debts, including your house if you have it or are repaying a home mortgage (unless it is Protected Residential Property).

The Basic Principles Of Bankruptcy

You will likewise not be launched from unliquidated financial debts (See below). You can not travel overseas without the composed consent of your trustee in bankruptcy.

This will make it hard for you to borrow money, specifically while the listing gets on your credit scores report. It might additionally have a result on your ability to rent building, access telecommunications and also other services or acquisition insurance. You will have a limitation on just how much you can obtain, approve items on credit rating or employ acquisition, or deal to provide products or services without revealing to the loan provider or consumer that you are an undisclosed bankrupt ($5,882 as at September 2020 go to www.

Some Ideas on Liquidation Melbourne You Need To Know

You can not be a director of a company or otherwise proactively entailed in the management of a firm. If you acquire or win cash or building while you are insolvent it will certainly be taken by the trustee in insolvency (up to the amount required to pay all your debts, interest and also the expenses of administering your bankruptcy this can be a lot even more than the complete amount of your financial obligations).

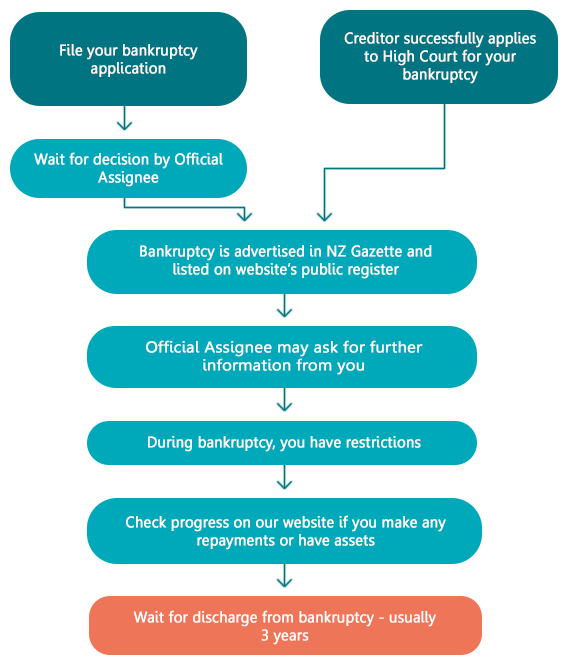

Personal bankruptcy generally lasts 3 years and also 1 helpful site day however can be expanded in some scenarios to 5 or 8 years. The length of time it lasts depends upon whether you behave truthfully (level about all your property and also debts): follow the guidelines and also co-operate with your trustee. filing bankruptcy on your own Your insolvency can additionally be prolonged for non-payment of income payments.