Not known Factual Statements About Personal Insolvency

Table of ContentsUnknown Facts About BankruptcyNot known Incorrect Statements About Bankrupt Melbourne How Insolvency Melbourne can Save You Time, Stress, and Money.What Does Liquidation Melbourne Do?How Bankruptcy Victoria can Save You Time, Stress, and Money.

As Kibler stated, a company requires to have a really excellent reason to restructure an excellent reason to exist and the increase of shopping has made stores with substantial store visibilities out-of-date. 2nd opportunities might be a beloved American perfect, however so is development and the growing pains that come with it.Are you gazing down the barrel of stating on your own insolvent in Australia? This is no excuse for a person leading you down the path of stating personal bankruptcy.

We understand that everybody deals with economic strain at some factor in their lives. In Australia, even houses and also businesses that appear to be thriving can experience unexpected hardship because of life changes, task loss, or elements that run out our control. That's why, right here at Obtain Out of Financial Obligation Today, we provide you experienced guidance as well as examinations concerning truth consequences of personal bankruptcy, financial debt agreements and also other economic problems - we want you to come back on your feet and also stay there with the most effective possible result for your future as well as all that you desire to acquire.

Some Known Details About Bankruptcy

It is worth noting that when it concerns financial obligation in Australia you are not the only one. Personal personal bankruptcies as well as insolvencies are at a document high in Australia, impacting three times as several Australian compared to twenty years earlier. There is, nevertheless, no security in numbers when it pertains to declaring bankruptcy and also insolvency.

Something that many Australian people are uninformed of is that in actual truth you will be provided on the Australian NPII for simply lodging an application for a financial obligation arrangement - Liquidation Melbourne. Lodging a financial obligation arrangement is in fact an act of stating on your own bankrupt. This is an official act of bankruptcy in the eyes of Australian regulation also if your financial obligation enthusiasts do decline it.

During and after your insolvency in Australia, you have certain commitments and face certain limitations. Any type of creditors that are wishing to acquire a copy of your credit score report can request this info from a debt reporting company. As soon as you are declared bankrupt protected financial institutions, who hold safety and security over your home, will likely be entitled to seize the property and offer it.

The Single Strategy To Use For Bankruptcy

a home or vehicle) When declared insolvent you must educate the trustee instantly if you come to be the beneficiary of a dead estate If any one of your lenders hold legitimate safety over any kind of property and also they do something about it to recover it, you have to aid You must surrender your ticket to the trustee if you are asked to do so You will certainly continue to be responsible for financial debts incurred after the day of your personal bankruptcy You will will not have the ability to act as a supervisor or manager of a business without the courts permission As you can see becoming part of insolvency can have long-term negative effects on go your life.

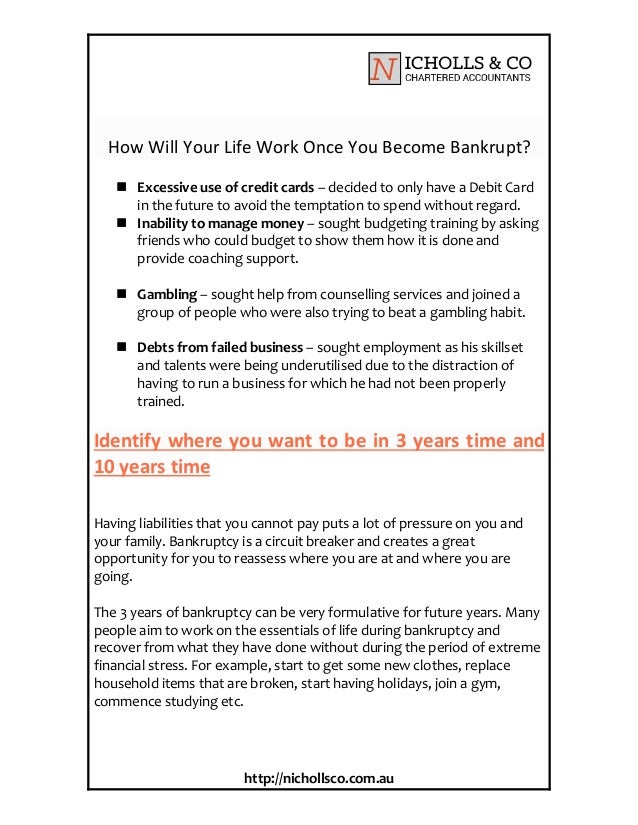

Becoming part of insolvency can leave your life in tatters, shedding your home as well as possessions and also leaving you with absolutely nothing. Prevent this end result by speaking with a financial debt counsellor today concerning taking a various thrashing. Personal bankruptcy requires to be effectively thought of and also planned, you ought to never enter insolvency on an impulse as it can have impacts on you that you may not even know. Liquidation Melbourne.

We offer you the ability to pay your debt off at a decreased price as well as with minimized passion. We recognize what lenders are trying to find as well as are able to work out with them to give you the most effective opportunity to settle your financial debts.

The smart Trick of Bankruptcy Advice Melbourne That Nobody is Talking About

What is the distinction in between default and also personal bankruptcy? Failing on a funding suggests that you've violated the promissory or cardholder arrangement with the lending institution to make settlements on time.

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)

The Basic Principles Of Personal Insolvency

If you skip on a vehicle funding, the loan provider will certainly usually try to retrieve the vehicle. Unsecured financial debt, like bank card debt, has no collateral; in these situations, it's tougher for a debt collector to recover the financial obligation, but the firm may still take you to court and also attempt to put a lien on your residence or garnish your incomes.

The court will certainly appoint a trustee who may sell off or offer several of your ownerships to pay your financial institutions. While the majority of your financial obligation will certainly be terminated, you may select to pay some financial institutions in order moviepass bankrupt to keep an automobile or house on which the lender has a lien, says Ross (Bankruptcy Melbourne).

If you work in a market where employers inspect your credit history as part of the hiring process, it might be harder to obtain a new job or be promoted after bankruptcy. Jay Fleischman of Money Wise Law claims that if you have charge card, they will often be shut as quickly as you declare personal bankruptcy.